Discover

Cash Flow Modelling

Understanding and managing your cash flow is vital for long-term financial success.

At Wimbledon Wealth, we provide comprehensive cash flow modelling services that give you clarity and transparency about your financial future. Our approach helps you visualize your financial landscape, enabling you to make informed decisions today that pave the way for the life you want to live.

Tailored Financial Solutions

Our cash flow modelling service is available to all clients, regardless of their financial situation. We create bespoke plans that consider your unique circumstances, including income, expenses, savings habits, and future goals. Whether you are single, a couple, or a family, we design a model specifically for you.

Key Goals and Outcomes

Clients often seek our services to answer critical questions about their financial futures, such as:

01

When can I retire?

02

Is my retirement goal affordable?

03

Will I run out of money based on my current income and savings?

By inputting all your financial details, we help you understand your position and what actions you need to take to achieve your goals. Major life events, such as retirement, education fees, home purchases, and other savings goals, are incorporated into your cash flow model.

Sophisticated Tools for Accurate Modelling

We utilize a powerful, globally recognized software to develop our cash flow models, ensuring that your plan is based on industry-standard practices. While we cannot disclose the specific tool we use, it is trusted by thousands of financial advisers worldwide.

Personalized Approach

Each cash flow model is tailored 100% to your specific situation. We gather information from you to build a plan that reflects your unique circumstances. This includes detailing all your investments with their respective growth rates, contribution levels, and withdrawal dates. Our models also account for significant events like income cessation, pension initiation, property sales, and purchases.

Regular Updates for Ongoing Relevance

Your financial situation can change, so we update your cash flow model at least once a year. If there are changes in your personal, work, or financial life, we make adjustments to ensure the model remains relevant and accurate.

Insights and Education

Our process includes one-on-one sessions where we share insights derived from your cash flow model. As your wealth manager, I will present your tailored model, explaining how it addresses your specific financial challenges. This collaboration empowers you with the knowledge and confidence to make informed financial decisions.

Overcoming Challenges

We understand that many clients struggle with defining their spending goals. Our service addresses this challenge by modeling various retirement income scenarios. We help you identify what is realistic and what adjustments are necessary to achieve your financial objectives.

Take Action Now

Don’t leave your financial future to chance. Gain confidence in your financial position with our cash flow modelling service. Book a free consultation today and discover how we can help you achieve your dreams.

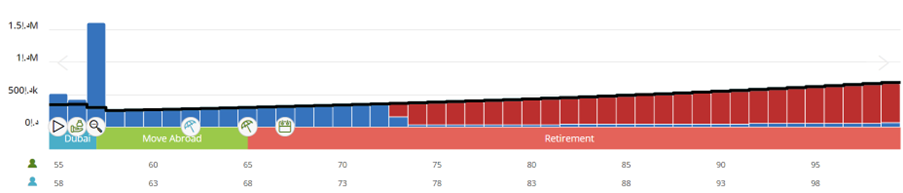

Clients Base Plan

This tailored base plan illustrates the client’s unique financial situation, incorporating their income, expenses, and future events. It serves as the foundation for understanding their financial journey and planning for the years ahead.

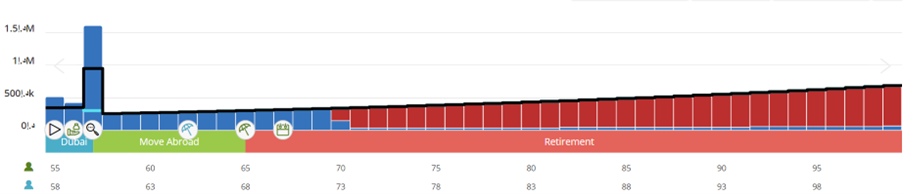

Clients Base Plan + Personal Financial Goal

This insight models the impact of specific financial goals, such as a house purchase or mortgage payoff. It highlights how achieving these objectives influences the client’s overall financial plan, helping them make informed decisions for a secure future.

Contact

Let’s Get in Touch!

Thank you for your interest in Wimbledon Wealth. Please submit the completed form so we can direct you to the right person.